Photo credit dilettantiquity

The following is an excerpt from a piece I wrote for InvestorPlace.

A stock market education is expensive, and I’m not talking about the cost of a Harvard or Wharton MBA. Those, while pricey, can actually be cheap by comparison.

Unfortunately, there is no real shortcut here. All stock market education is, to some extent, straight from the school of hard knocks. You will make mistakes. Even legends like Warren Buffett and George Soros made horrendously bad investment moves at various points in their careers. Sure, you can spend money on investing books or even a fancy trading system. But the real cost of a stock market education is measured in money lost and profits foregone due to investing mistakes. And over a lifetime of investment, that can mean millions — if not tens of millions — of dollars.

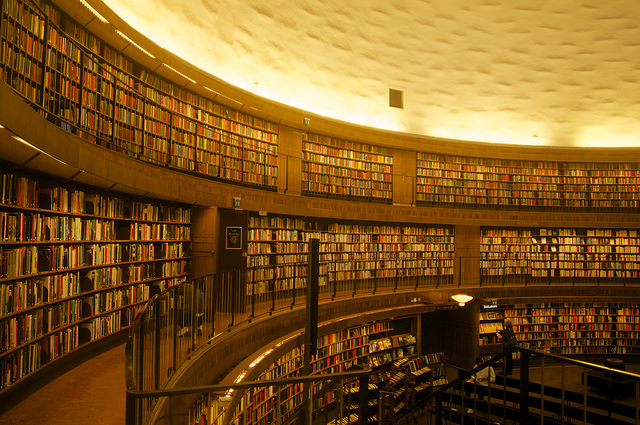

But new investors can still give themselves a leg up by studying beforehand. Every serious investor should have a solid library of investing books.

I should be clear here; if you blindly follow a trading strategy verbatim out of an investing book, you’re likely to be disappointed with the result. Investing is often more art than science, and what worked for the author might not work for you. But by voraciously reading as much as possible, you can take the tidbits of insight that you glean from each book, and eventually cobble them into a trading style that works for you.

I’ll give you a head start with five investing books I keep in my library… and that I recommend you keep in yours.

The Intelligent Investor

I’ll start with Benjamin Graham’s classic The Intelligent Investor.

You simply have no business investing a single red cent until you familiarize yourself with Benjamin Graham. This is the man that invented the investment profession as we know it today. Graham was actively advocating a certification program for analysts in the 1940s, 20 years before the CFA program got off the ground. And he was Warren Buffett’s professor and mentor at Columbia Business School. Without Graham, there would have never been a Buffett — or at least not the investing legend we know and love.

The Intelligent Investor is a solid introduction to value investing. And while many of Graham’s specific tricks of the trade (such as buying stocks that are selling for less than their net current assets) are rarely usable in today’s more efficient market, the basic principles are as relevant as ever.

My favorite anecdote from the book is the story of the infamous Mr. Market. Graham compared investing to doing business with a wildly emotional business partner, Mr. Market, who continuously swung from extreme optimism to extreme despair and right back to extreme optimism. The analogy might actually be more applicable today than when Graham first wrote it.

Graham was a rare, independently minded genius in a field often associated with a herd mentality. Keep a copy of the Intelligent Investor on your desk. It will keep you grounded.