“This year’s presidential election is the most important in the history of the republic.”

Maybe. But the funny thing is, I seem to remember hearing the same thing four years ago … and four years before that … and four years before that…

It seems that every election is the most important in history.

Now, I’m not suggesting that the 2020 election isn’t important. And it may be one of the more significant elections of the past several decades.

But this reminds me of a quote by Adam Smith, the Scottish-born founder of economics.

Following the British loss to the Americans at Saratoga, Smith’s colleague John Sinclair fretted: “If we go on at this rate, the nation must be ruined.”

Smith’s reply was effectively a shrug: “Be assured, young friend, that there is a great deal of ruin in a nation.”

Smith’s point was simple enough: It’s never quite that bad, and business has a way of muddling through.

How Elections Affect Markets

With that said, let’s take a look at how the election might affect the stock market going forward. As I mentioned last week, certain sectors tend to do better under Democratic administrations, and others under Republicans.

Today, let’s take a look at how the markets as a whole have fared under different election outcomes.

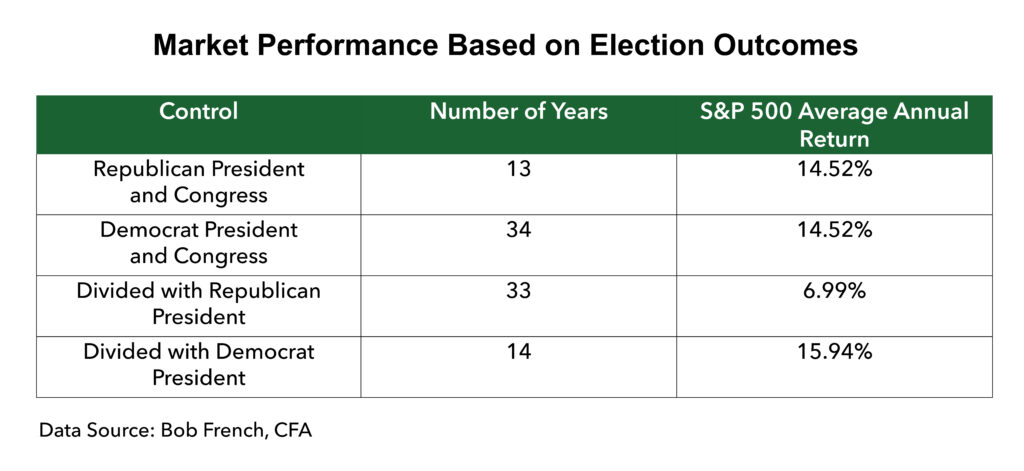

Bob French crunched the numbers from 1926 to 2019 and found the following results:

When Republicans controlled the presidency and both houses of Congress, the market returned 14.52%.

But here’s the funny thing: The market saw the exact same returns when Democrats controlled the presidency and both houses, and it wasn’t materially different when we had a divided government with a Democrat in the White House, at 15.94%.

Returns were lower when we had a divided government with a Republican in the White House, at 6.99% per year.

Now, we should take the results above with a grain of salt.

In the first and fourth scenarios (Republican president and Congress, and divided with Democrat president), there were only 13 years and 14 years of data, respectively.

That’s generally not considered enough to draw meaningful conclusions.

The Situation Matters

Digging into the details is instructive.

Under Republican George W. Bush’s administration, stocks declined 5.6% per year, making his time in office one of the worst in stock market history.

But is that because his presidency was uniquely bad? Or because he had the misfortune of starting his presidency just as the 1990s dot-com bubble was bursting — and of being the sucker left holding the bag when the mortgage crisis blew up in 2008?

This is to say the situation matters. And whoever takes the White House this fall will inherit an economy that’s been held together with duct tape and Federal Reserve stimulus following the COVID-19 crisis.

The market’s performance will likely depend more on the Fed’s ability to gently wean the market off of stimulus rather than on presidential policy after the election.