In today’s market, high dividend yields aren’t particularly easy to come by. But if you’re willing to go a little outside the beaten path, there are still some juicy yields to be found.

Today, let’s take a look at global specialty chemicals company LyondellBasell Industries (LYB). Lyondell has a diversified product portfolio, though most of its chemical products are petroleum based.

Apart from its core petrochemicals businesses, Lyondell also operates a crude oil refining business that produces gasoline, diesel fuel, jet fuel and other products.

Lyondell, like most cyclical stocks tied even remotely to energy, got is head bashed in during the COVID bear market. From its late 2019 peak to its March 2020 low, Lyondell lost two thirds of its value. But the shares have been pushing higher ever since, and barring another destabilizing bear market, I expect the shares to continue to outperform even if energy remains depressed for months or even years.

Remember, Lyondell doesn’t sell oil; it buys it as a feedstock. Depressed energy prices actually lower the company’s production costs. Lyondell remains economically sensitive, of course, as demand for its products is highly cyclical. But the company made it through a very difficult string of months without incident, and it’s hard to imagine anything more disruptive than the March and April lockdowns coming down the pipeline.

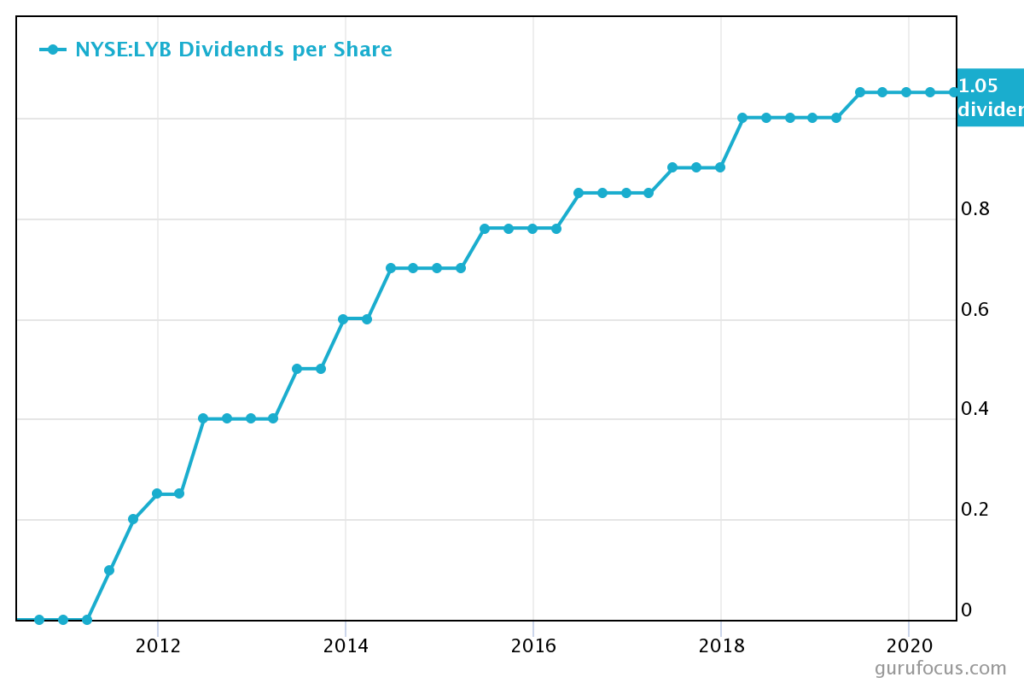

Let’s talk dividends. At current prices, LyondellBasell sports a dividend yield of 5.7%. That’s very attractive in a world in which the 10-year Treasury yields less than 0.7%.

Importantly, Lyondell is also a major dividend grower. Its quarterly payout has more than doubled since 2013. Dividend growth may be a little sluggish for the next year or two as the company builds up case reserves for what could be a difficult economic environment. But with a payout ratio of 69%, there’s enough wiggle room for at least a modest hike over the next few quarters.

Value investors have been expecting a large-scale rotation out of flashy growth stocks and into gritty value stocks for months. That’s not likely to happen while COVID cases are still rising and the threat of new lockdowns looms over the market. But if we get a working vaccine in the coming months and life starts to look a little more normal, we may finally get that rotation into value stocks. And if we do, we should expect LyondellBasell to get a nice pop.

So, think of it like this. Our baseline scenario has us pocketing nearly 6% in dividends while enjoying market returns. But if we get a little help from a recovery in value names, Lyondell could be a major outperformer.

Charles Lewis Sizemore, CFA is the principal of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas.