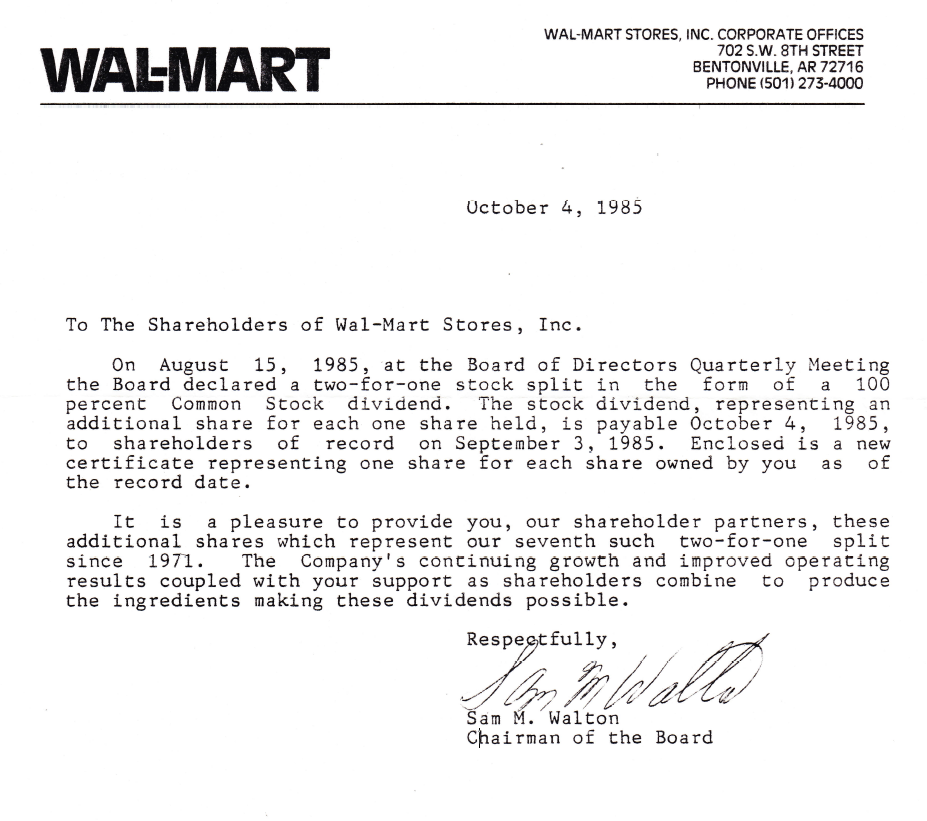

I was digging through an old file cabinet that had belonged to my grandfather, and I found this little blast from the past: a Walmart (WMT) letter to shareholders from 1985, signed by Chairman and company founder Sam Walton.

As a child in the 1980s, I actually remember my grandfather proudly showing me a paper certificate for his shares of Walmart stock, and I remember the day he went electronic by handing the paper certificates to the trust department at the bank. He wasn’t sure he trusted the system and made sure to photocopy his certificates before handing them over…just in case.

Paper stock certificates seem so anachronistic today in this age of online trading and instant liquidity. It makes me wonder how different the world of trading and investment will be when my future grandchildren are going through a drawer of my personal effects.

The truth is, I’m not sure how beneficial instant liquidity is in building long-term wealth. In fact, it’s probably downright detrimental. When my grandfather bought his shares of Walmart, the high cost of trading discouraged him from short-term trading. As a result, he was a de facto long-term investor, which ended up working out to his benefit as Walmart grew into one of the largest and most successful companies in history. Long after my grandfather passed away, the cash dividends from the Walmart stock he accumulated in his lifetime continued to pay for the retirement expenses of my grandmother–and for my college tuition! Had my grandfather had access to the instant liquidity of today, he might have been tempted to sell far too early.

My grandfather also practiced his own version of Peter Lynch’s advice to invest in what you know long before Peter Lynch became a household name. He was an Arkansas boy–born and raised not far from Fort Smith–and he liked to invest in local companies that he could observe firsthand. Walmart was one of those local companies; its headquarters in Bentonville is less than an hour and a half from Fort Smith by car.

I remember fondly my grandfather taking me to Fort Smith’s Walmart and buying me an Icee at the snack bar. He liked to walk the aisles personally to see what Mr. Walton was doing with his money. That might seem a little old fashioned today, but then, it’s still the approach taken by Warren Buffett and by plenty of long-term value investors. If done right, it works.

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.