To say the coronavirus bear market has been hard on REITs would be an understatement. While the S&P 500 was down about 35% at its lowest point (thus far), the Vanguard Real Estate Index Fund (VNQ) was down 44%. And the damage in many individual REITs was far worse.

As an example, triple-net retail REIT VEREIT (VER) dropped 65%.

REIT prices should be lower. The next two quarters promise to be an unmitigated disaster for REIT earnings. Recessions have come and gone. But we’ve never had a situation where large swaths of the economy were shut down, virtually instantly, in an otherwise healthy economy. The shear strangeness of the entire exercise and the fact that there is no obvious end to it add to the difficulty of assessing the damage.

And as damaging as it would be to investor confidence, several REITs — including VEREIT — may end up having to reduce or eliminate their dividends, at least for a couple quarters. If tenants cannot continue making payments, eventually the REITs will have a hard time continuing to pay their investors.

All of that said, a 65% drop in the share price suggests more than an awful quarter or two. A decline of that nature in an otherwise boring and stodgy company suggests the property values are impaired and that rental revenues will be permanently lower.

For some REITs, that might very well be true. Mall properties were a tough sell even before the coronavirus scare, and they haven’t somehow become more attractive over the past six weeks. Even the office market might have long-term or permanent damage to demand as companies have been forced to make working from home feasible. Most work will return to an office setting once the dust settles. But some likely will not.

It’s harder to make that case for restaurants and high-traffic retail properties like the ones VEREIT owns. When your typical tenant is a dollar store, a pharmacy or a gym it’s pretty safe to assume your properties will still be in demand once life returns to normal. Tenants might skip a payment or two. But longer-term damage is unlikely.

A Look at the Portfolio

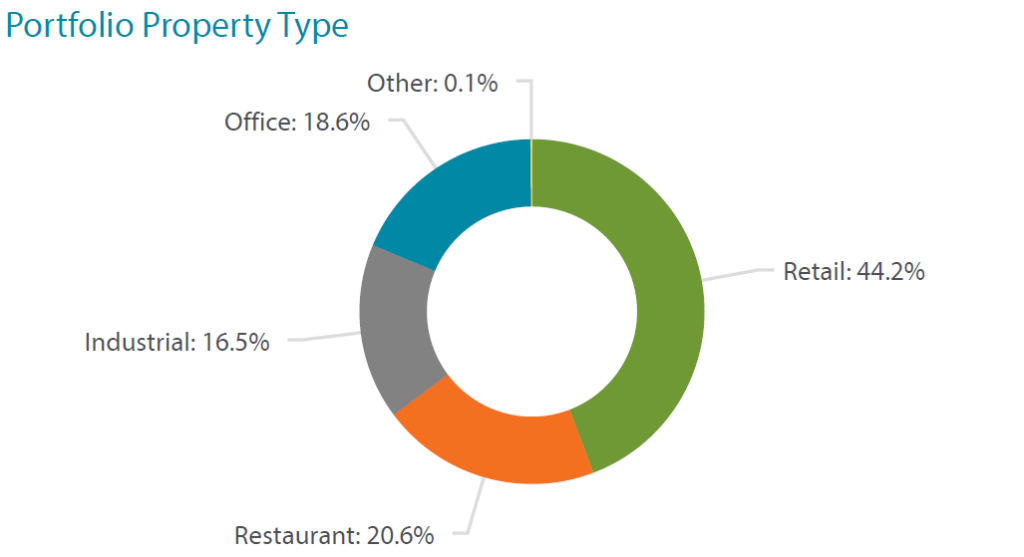

VEREIT has a portfolio of nearly 4,000 properties, the largest consisting of retail properties. It’s the 21% allocated to restaurants that seems to have Wall Street the most worried.

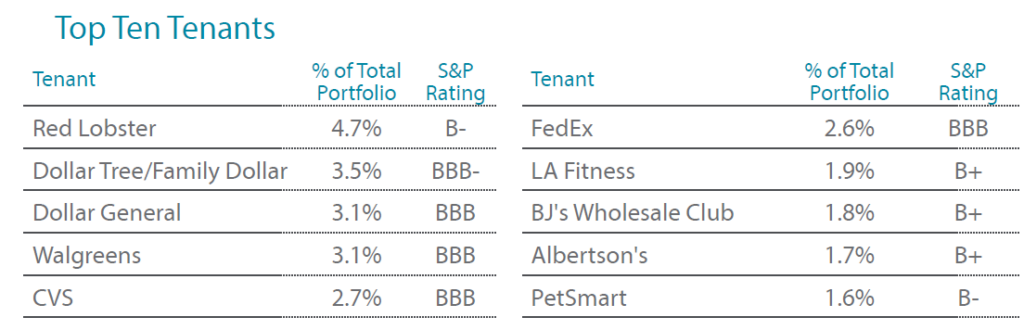

VEREIT’s largest single tenant is Red Lobster at 4.7%. Red Lobster is a junk-rated tenant that looked somewhat shaky even before the coronavirus panic. It certainly looks no less shaky now. Most Red Lobster locations are operating as carry-out only in response to stay-at-home orders. We have no visibility as to what sales or profits will look like, but we can assume it’s not good.

Digging deeper into the restaurant portfolio, the numbers are a mixed bag. Only 3.3% are rated investment grade. Rent coverage as of year end was good enough at 2.63 times. (Rent coverage defined as (EBITDA + rent) / rent.) Of course, those numbers are now meaningless until we see guidance coming out of the restaurant sector.

Rents collected from restaurants don’t go to zero. But it’s safe to assume that some — and maybe a large portion — of the rents get reduced or deferred over the next several months.

I’m a lot less concerned about the rest of the portfolio. Apart from Red Lobster and perhaps LA Fitness, the remaining top-10 tenants would seem relatively immune from disruption.

44.2% of VEREIT’s rents come from retail businesses (apart from restaurants). There will be rent deferrals and concession here, particularly in the 3.3% in entertainment properties, the 2.9% in home furnishing, and the 2.4% in auto-related tenants. But assuming stores are allowed to reopen within the next month, the long-term damage to this segment of the population would seem pretty minimal.

Office and Industrial properties make up 18.6% and 16.5% of rents, respectively. These segments will not be free of disruption, of course, and there may be a few tenants that get in financial trouble. But I’m not expecting much in the way of coronavirus-related rent deferrals or reductions here.

VEREIT’s risk mainly comes down to its restaurant portfolio and to how long the world remains locked down.

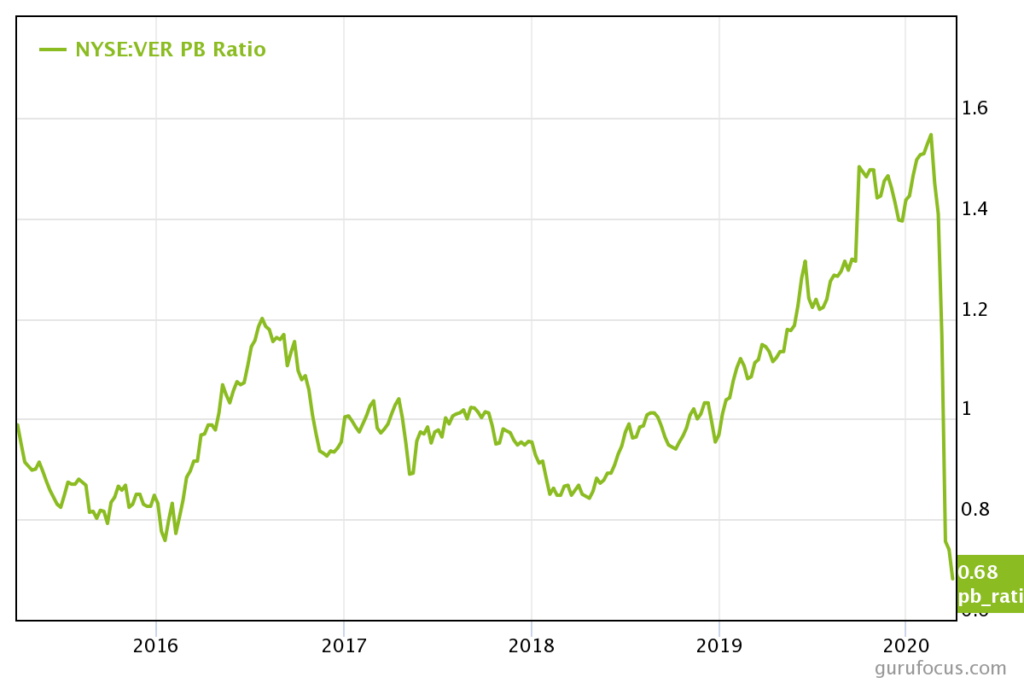

VEREIT Price/Book Ratio

After the share price swoon, VEREIT trades at a price/book ratio of 0.68. Now, REITs generally have understated price/book ratios as the value of their real estate portfolio isn’t regularly marked to market and is actually reduced by depreciation. But just for giggles, let’s assume assume that book value is a reasonable estimate for the value of VEREIT’s portfolio.

At current prices, you could write off the entire restaurant portfolio, giving it a value of zero, and VEREIT would still be worth more dead than alive, trading at a price.book ratio of less than 1.

Obviously, the restaurant portfolio is worth more than zero. Most of the restaurants are likely to continue business as usual and won’t miss as much as a single rent payment. But even if Red Lobster and a large minority of its restaurant tenants were to come under severe stress, VEREIT’s share price would seem ridiculously low.

What About Cash Flow?

We’re stabbing in the dark here. We don’t have great numbers to play with. But let’s say restaurant rentals go to zero in the second quarter and then recover to 70% in the third and fourth quarters. That’s obviously extreme and isn’t a realistic scenario. But, frankly, we’re all under quarantine and have nothing else to do, so humor me.

VEREIT had rental revenues of $1.2 billion last year, of which approximately $240 million came from restaurants. We’ll chop $60 million off for the second quarter and $18 million each for the third and fourth quarters. That reduces full year rental income to something in the ballpark of $1.1 billion.

Chopping ~$100 million off of adjusted funds from operations gets us something in the ballpark of $600 million for the year. That’s slightly below the $665 million paid last year in dividends on the preferred and common stock. But we’re also assuming that restaurant rental income literally goes to zero, which it won’t.

VEREIT also had approximately $1.35 billion available on its revolving credit facility that it could presumably tap as a short-term fix.

I’m playing fast and loose with the numbers here because, frankly, it’s an exercise in futility to try to be exact given the degree of uncertainty faced. But it’s fair to say that VEREIT isn’t facing insolvency even under very negative scenarios. I think it is possible they could reduce or delay their dividend for a couple quarters as an abundance of caution. But I don’t think they’ll necessarily need to.

Sentiment towards REITs is awful right now, and further declines can’t be ruled out. But if you have a time horizon of even a year or two, this would seem to be a good opportunity to accumulate shares.