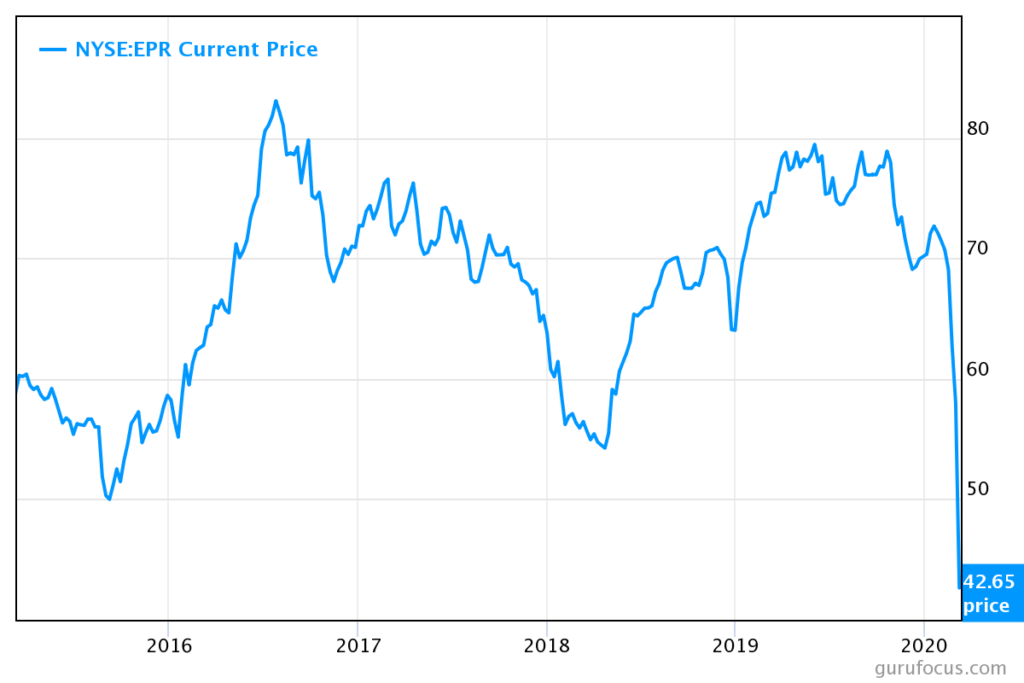

EPR Properties (EPR) has gotten utterly annihilated during this market selloff. It was down 36% yesterday alone and is down 65% from its 52-week highs.

It’s easy to write off a move like that as “irrational.” But is it? As a REIT specializing in entertainment properties, does the coronavirus panic materially impact the company?

The short answer is “yes,” but probably nowhere near enough to justify the destruction of the shares.

EPR had its quarterly investor call at the end of February, and one of the analysts brought up coronavirus and how it might affect the company:

Analyst: Okay, okay. And then just one last one for me. I don’t know if you guys have this off hand. But just when SARS hit early in the 2000s. Kind of do you remember what the impact was on theater attendance or kind of the Experiential retail tenants that you guys kind of invest in? Vis-à-vis, what could happen if the Coronavirus continues to spook people?

EPR CEO Greg Silver: Sure. It’s actually a great question, Craig. And we went back, and I’ve gone back and looked at it. And it really did have a negligible effect. If you recall, SARS actually affected Canada more than it did the U.S. It showed up mainly in Toronto. So if you use that as a kind of a set, it was really impactful for about 20 to 35 days, but to the overall year, it had a negligible effect.

Now, coronavirus is different, of course. While far less deadly, the economic impact is likely to be far worse due to the reaction to it: quarantines, closures of public events, etc. None of this is good for a company that in the business of entertaining people in large groups.

It’s important to remember that EPR is a landlord and is not running an entertainment business itself. But its tenants are going to take a lot of pain this year. And if movie ticket sales are affected, its largest tenant — AMC — could get into some real trouble.

None of this should be bad enough to put EPR at serious risk or even cause it to cut its dividend, assuming life gets more or less back to normal within the next month or two.

Meanwhile, the company has opted to hoard cash as a precautionary measure. EPR recently walked away from a planned $1 billion gaming investment, which will likely lower earnings and funds from operations for the year. But it was likely the right move, all things considered.

This is by no means an in-depth analysis. This are simply my initial thoughts after seeing the stock implode this week, and I’ll do a deeper dive on the company in the days ahead. But for now, if you’re looking for gems amidst the rubble, EPR is worth a look. At current prices, it sports a gargantuan 16% dividend yield.

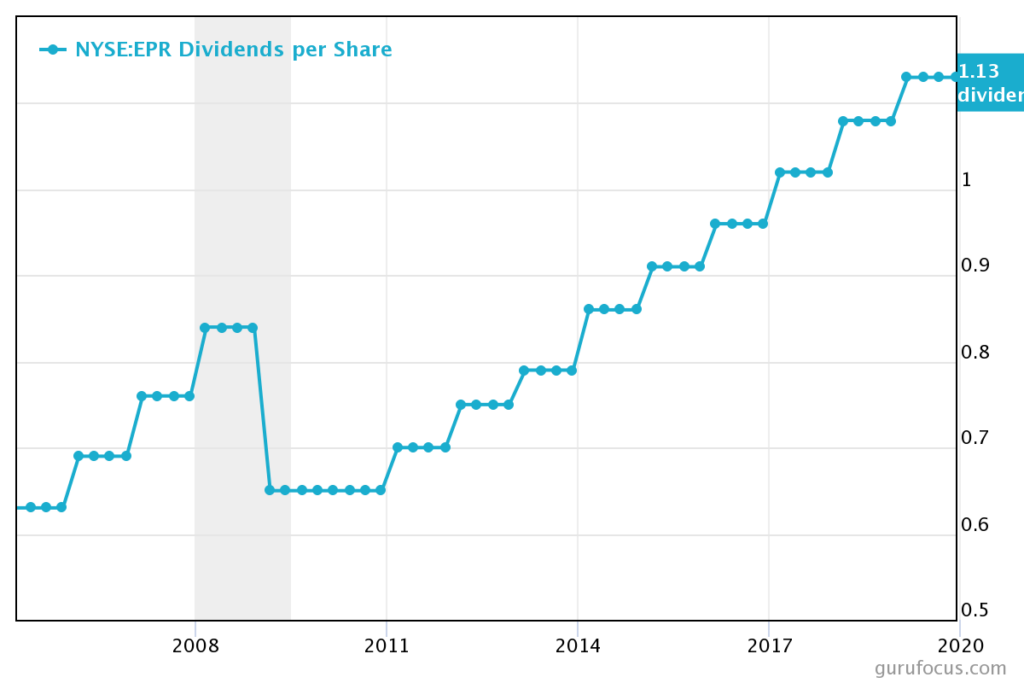

It’s worth noting that EPR cut its dividend during the 2008 financial crisis by about a quarter and that it took several years to return the dividend to pre-crisis levels. Depending on how long the coronavirus scare lasts and what sort of financial mess its tenants face, something like that could happen again. But at current prices, it would seem worth the risk.

Disclosures: Long EPR