I like saving money. A lot.

In fact, I’m a cheapskate and actually take pride in my stinginess.

But you won’t see me fighting the crowds on Black Friday. Not going to happen. Life is far too short to explore the depths of human misery that I see on display the Friday after Thanksgiving every year. Lines forming the night before… elbows flying… fighting over boxes with fellow shoppers… the vulgarity of it all.

No, whatever money I would save isn’t worth the lifetime of bad karma I’d provoke fighting for a space in the mall parking lot.

Still, if you’re in the retail business, Black Friday matters because it gives you an indication of what to expect for the remainder of the holiday shopping season. Nearly a third of all retail sales happen in the month between Thanksgiving and Christmas. So if sales bomb on Black Friday, it can be a bad sign of things to come.

Interestingly, “Black Friday” is something of a changing concept these days. Stores desperate for a finite number of customer dollars have been opening earlier and earlier, and now Thanksgiving Thursday itself is a major shopping day. And of course, internet shopping has also taken some of the sense of urgency out of the whole endeavor.

Nevertheless, you’re going to be blasted with Black Friday news stories over the next several days. Black Friday sales growth has been somewhat sluggish since 2008, but if 2016 to date has been any indication, then I’d expect some surprises this year. With a new president promising to “make America great again,” consumers might – just might – open their wallets a little wider this year.

But I’d be very careful about drawing meaningful conclusions from any reports you read between now and Christmas. Because while Black Friday spending is a big deal for mall retailers, it’s overall effects on the economy are a lot smaller than you might think.

Much of what gets purchased during the holiday shopping season is fairly cheap and disposable. We’re talking about clothes, toys and consumer gadgets that tend to get used for a year or two and then tossed. But what really supercharges the economy are big-ticket items typically purchased on credit.

Think about it. When you buy something on credit, you’re essentially spending tomorrow’s money today. So big-ticket items are like gasoline on the fire.

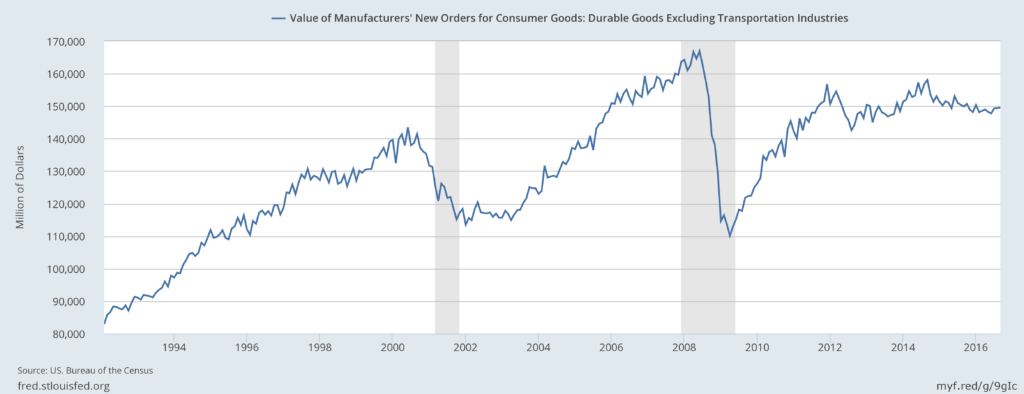

Well, growth in this segment of the market has been tepid for a long time. Consider the following chart, which tracks orders of consumer durable goods. These are items expected to last three years or more, such as appliances, furniture, large electronics, etc. As you can see, growth was robust and steady throughout the 1990s, eased during the 2000-2002 slowdown, and then rocketed even higher until 2008. Of course, orders absolutely collapsed during the Great Recession that started in 2008. But the most interesting part is what happened after that.

Durable goods orders enjoyed a nice recovery once the economy came out of deepfreeze. But then in 2012, they flatlined. And they’ve been grinding sideways ever since.

What’s the story here?

Part of it is housing. The housing boom of the 2000s created massive demand for applicances. You have to have something to fill up that massive McMansion, after all. And as home buying has been sluggish since 2008, so has been buying of consumer durables.

But there’s a much bigger factor at work here, and that is demographics. The Baby Boomers are done buying durables. Sure, they might replace a broken refrigerator now and then. But few of them are furnishing a new house. In fact, many are actually downsizing and are giving away furniture they no longer need.

Meanwhile, the Millennials have been slow out of the gate to start families and buy homes of their own. And Millennials that are starting families tend to be more fiscally conservative than prior generations. For all the flack that Millennials take – and hey, a lot of it is deserved – their fiscal conservatism is actually pretty admirable.

The problem, as I wrote a few weeks ago in The Paradox of Thrift, is that what is good for the individual family – discipline and thrift – is bad for the economy as a whole, at least in the short term. So Millennial reluctance to spend like adults is still major headwind for the economy… and a reason that growth has been so lackluster for several years running. And we’re probably a good five years away from that materially changing.

So regardless what Black Friday looks like this year, try to keep a level head. We’re not likely to enjoy pre-2008 levels of growth any time soon.

And as for Black Friday itself… don’t debase yourself by fighting with the unwashed masses for that last bargain-basement blender on the shelf. That’s no way to live your life. Stay at home, eat some pumpkin pie and spend some time with your kids. Or at least relax and watch some football.