Photo credit: Alex Proimos

The following is an excerpt from 5 Simple Mistakes That Could Ruin Your Retirement.

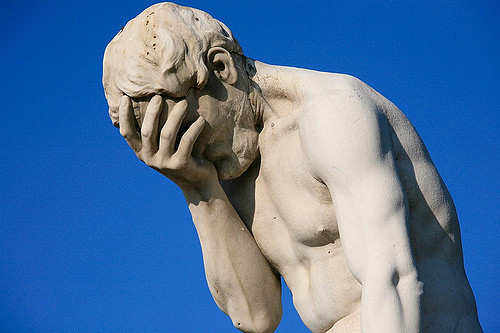

You can make a lot of mistakes in your youth … and assuming none of them get you killed or put in prison, you can generally recover from them. Time is on your side. But the closer you get to retirement, the less room for error you have.

Investing mistakes like that might make the difference between a comfortable retirement and working until the grave.As your nest egg gets larger, investing mistakes cost you a lot more. Think about it. If you lose 30% on a $10,000 portfolio, you’re out $3,000. That might be a single after-tax paycheck when you’re young. But imagine losing 30% on a $1 million portfolio. That’s $300,000. For most Americans, that represents years of income in the prime earnings years of your career.

Today, we’re going to look at five potential retirement mistakes that can dramatically affect your lifestyle. Some will be more relevant to younger investors and others to older investors. But all can potentially torpedo your retirement.

#1. Waiting Too Late to Start

If you save aggressively in your 20s, you have 40 or more years for those gains to compound. You can save at a more moderate level and let the capital markets do the heavy lifting for you. But the later you start, the harder it gets.

The best illustration of this I have ever seen is Richard Russell’s essay, Rich Man, Poor Man. Russell, who until his passing last year had covered the financial markets since 1958, gives an example of two savers. One opens an IRA at age 19 and sets aside $2,000 per year until the age of 25 and then stops. He invests for just seven years and then sits back and lets it compound.

A second saver starts saving at age 26, one year later than when our first investor stopped. He saves $2,000 per year until age 65, a period of 40 years.

So, we have one saver that started early and quit … and one that started just seven years later, but proceeded to save for 33 additional years. At age 65, who had a larger IRA?

Shockingly, the early investor. Assuming annual returns of 10%, Russell found that the early starter had a net worth of $930,641 by age 65 vs. $893,704 for the late starter.

Naturally, tinkering with the returns assumption will make a difference here. The stock market returns roughly 10% per year over the long-term, but returns vary wildly from year-to-year. But Russell’s point was simple enough: Start early when time is on your side.

If you’re already in your 30s, 40s or even older, you can’t undo your savings decisions from the past. But you can start now.

To continue reading, please see 5 Simple Mistakes That Could Ruin Your Retirement

[…] To continue reading, please see 5 Simple Mistakes That Could Ruin Your Retirement […]