I’m going to start this month with a prediction that might surprise you. I do not think that bonds are in imminent danger of a crash.

I do agree with the growing legion of investors—including the legendary Warren Buffett himself—who believe that the bond market is in a “bubble” of sorts. And I would certainly agree that at current yields, bonds have much greater downside potential than upside, making them quite risky. Nominal bond yields can’t fall below zero, after all, but they can rise significantly from here.

That said, I think this bubble might have a little longer to run, and this is good news for us. Even though we have no exposure to bonds in the Sizemore Investment Letter, we benefit from low yields as they make our income-oriented investments more attractive by comparison. Of course, I would expect the SIL’s recommendations to do at least relatively well in almost any interest rate environment, as most pay dividends that are both high and growing. Still, all else equal, I am quite happy to see rates stay low, and I think it is highly likely that they will.

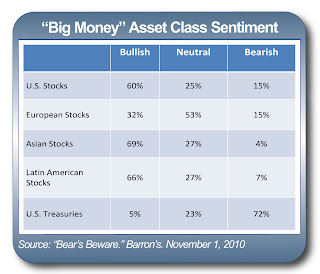

Here’s why: Bubbles practically never crash when they are widely expected to. And right now, if there is one consensus in the world of investing, it is that the bond bull market is over. Take a look at the chart below. Fully 95% of money managers interviewed by Barron’s are either bearish or neutral on Treasuries!

Even most bond fund managers—the people who stand to gain the most from a sustained bond bull market—are lukewarm at best towards the sector. Bill Gross, founder of PIMCO, is arguably the second most powerful man in the world of fixed income (second only to Fed Chairman Ben Bernanke, of course). Gross is the biggest bond fund manager in the world, and even he is bearish on the sector. He recently made a very public pronouncement that the 30-year bond bull market is over. I’m not one to bet against Bill Gross, of course, and I would be in no hurry to buy bonds at current prices.

But when sentiment is this lopsided in one direction, the odds are very good that the consensus will be wrong, at least in the short term. Yields will rise and bond prices will fall—eventually. Bill Gross will likely prove to be right. But for the next several months, don’t be surprised to see bonds defy the bears. This is as true of the corporate sector as the Treasury market. Colgate-Palmolive (NYSE: CL) recently set a new record for lowest yield on a five-year bond issue with a 1.53% yield.

This article originally appeared on InvestorPlace.

Charles Lewis Sizemore, CFA

This blog is a free service of Sizemore Financial Publishing LLC, publisher of the Sizemore Investment Letter.

If you’re not reading the Sizemore Investment Letter, then you are missing out on rock-solid investment recommendations designed to profit from the major macro trends shaping the world today.

SUBSCRIBE TODAY and get access to information that is simply not available anywhere else.

[…] Furthermore, I believe that the recent spike in interest rates is already nearing its end. Interest rates may never again fall to the lows seen earlier in the year, but the absence of inflation should guarantee that they stay low by historical standards. This should benefit our dividend-focused investments. (For a more detailed explanation of SCM’s views on interest rates, please see: “Is There a Bubble in Bonds?” and “There is NOT a Bond Bubble—at Least Not Yet.”) […]

[…] There is NOT a Bond Bubble — at Least Not Yet […]